Market Intelligence

Weekly Wool Market Commentary

Moses & Son is committed to providing our valued customers the most current information and data to empower your decision-making process. Discover our latest Australian wool market weekly update below, along with archived reports for your perusal and analysis.

2025-S36

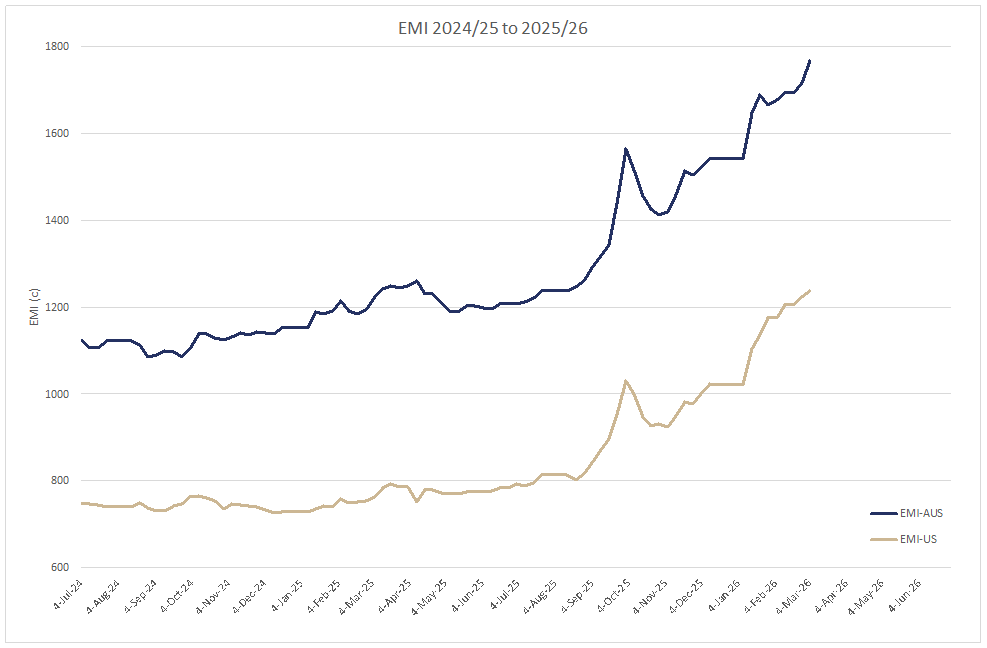

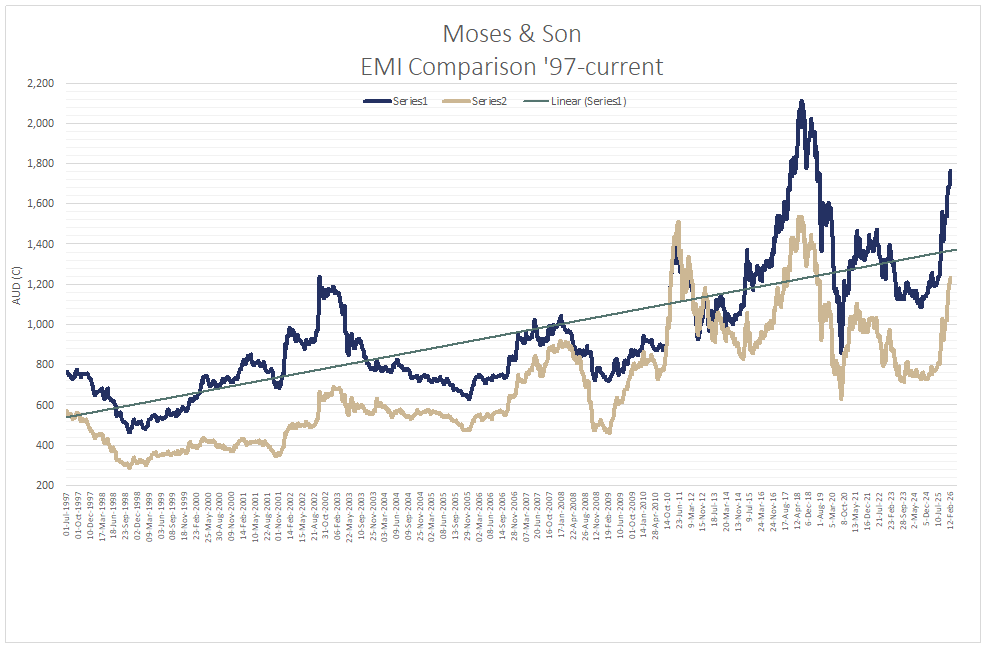

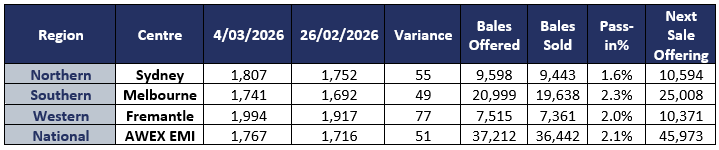

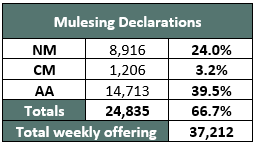

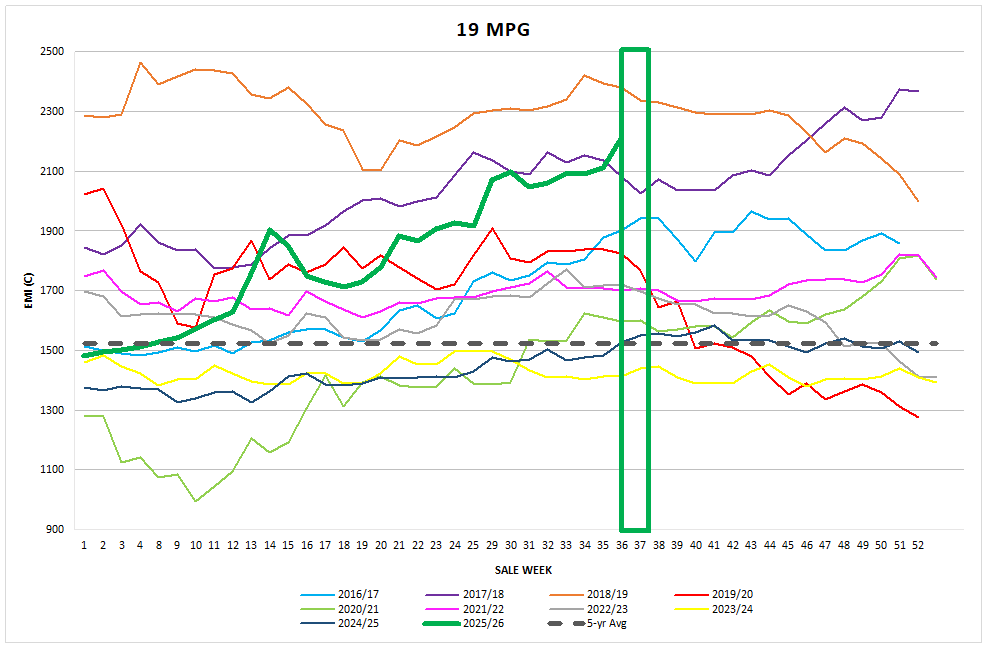

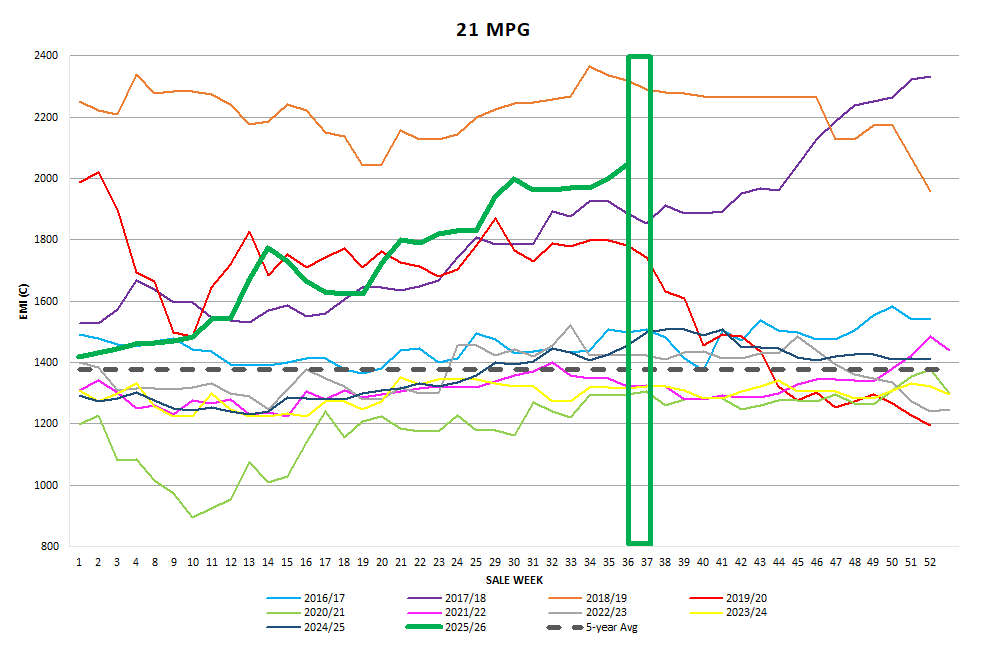

The EMI closed on 1767c up 51c at auction sales in Australia this week. After last week’s larger than normal offering this week’s national offering reverted back to 37,212 bales. 97.9% of the offering cleared to the trade with the EMI posting a 26 c rise on Tuesday and Wednesday saw the EMI followed through, with a 25c rise in the EMI. Whilst the large trading exporters dominated the market early in the week, aggressive participation from Indent Exporters provided the competitive tension needed to keep the market positive throughout the week.

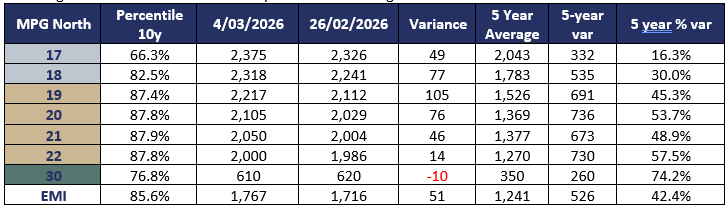

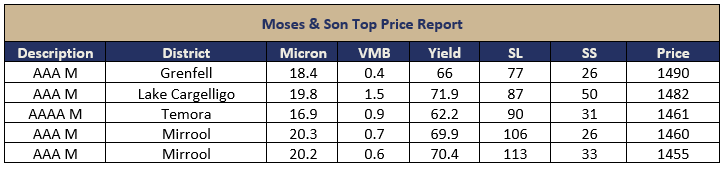

Merino Fleece

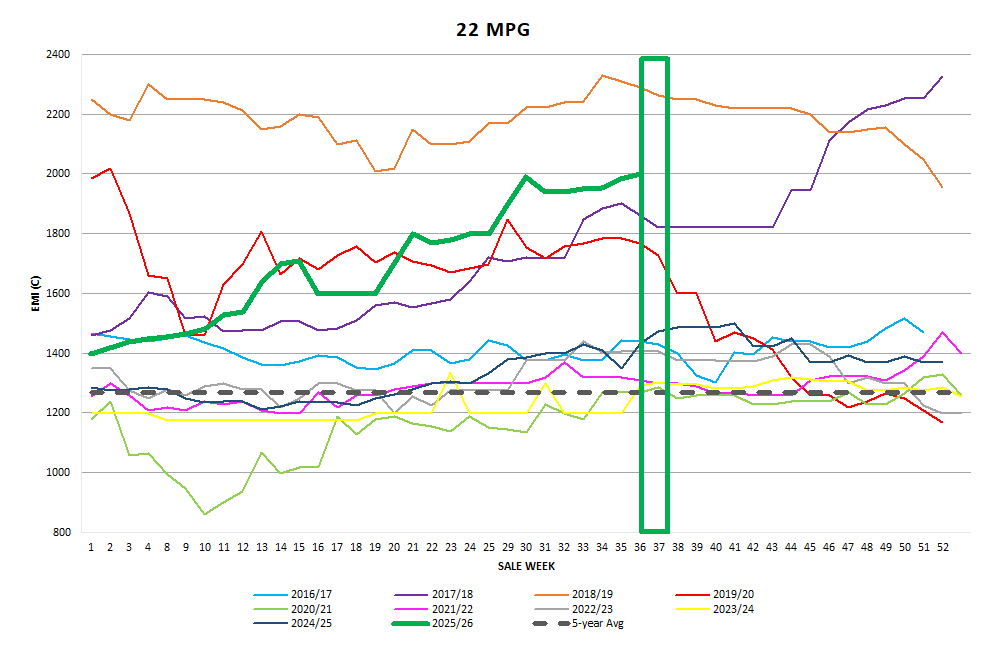

What a week for the Merino Fleece sector, leading the way with some of the largest weekly rises for the financial year, With many of the MPG’s adding between 49c-105c for the week. Lots with best style and specifications attracted substantial premiums whilst lots with medium and high VM, cast qualifiers and lower style types were met with discounts. Interestingly discounts for lower strength lots were more prominent on the lots with high Mid break and subsequently high CVH. Finer Merino types showed the greatest strength, rising 90 to 95 cents across the selling centres. Fremantle led the increases, with these types gaining 115 to 120 cents. Medium Merino wools also attracted strong buyer interest, recording gains of 80 to 85 cents

Merino Skirtings

Competition remained bullish on Tuesday for the best bulk and prepared lots with VM under 5% rising up to 50c. Lots outside these parameters remained steady for price with some inferior lots falling up to 20c. Wednesday’s skirting market continued to rise and by the closing bell adding 20-30c to their value.

Merino Cardings

Prices for best bulk merino crutching and stains continued to appreciate in price across all selling centres, whilst the shorter cardings opened fully firm. Wednesday saw eastern selling centres lots add another 10-20c to the MC but the Western MC fell 17c on the final day. 30% of the oddments were purchased by one exporter who purchased a similar % of the category last week.

Crossbred Fleece

Crossbred Oddments

Crossbreds

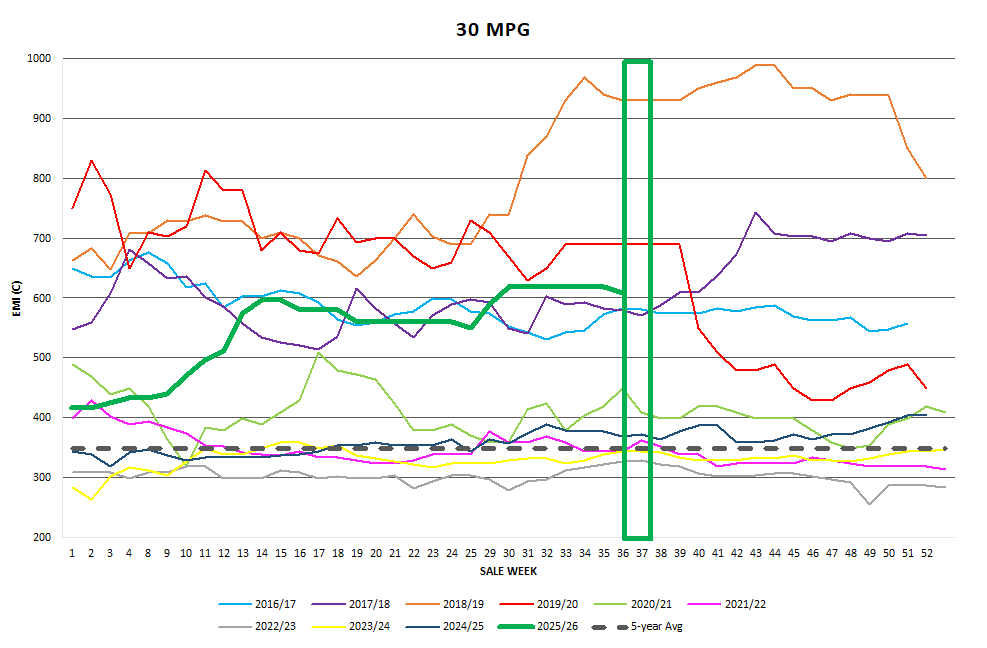

Opened the week strongly with the Northern Region offering a good selection of FNF lots with length between 100-120mm. Prices rose up to 13c for the 26 MPG and the best specified lots with all other MPG’s ranging from firm to 3c dearer. The market was cheaper on Wednesday with reports of a degradation in the style and specification of the offering in the eastern centres. Prices fell up to 20c on the 26-28 MPG’s whilst all others held generally firm.

Next Week

Next weeks offering climbs back up to 45,973 bales. Sydney and Fremantle will offer on Tuesday - Wednesday whilst Melbourne will offer on Wednesday – Thursday, due to the Monday Public Holiday in Victoria. Early indications are that the market should trade around this week’s levels, however this will rely heavily on the news from the Middle East. ~Marty Moses

Market Commentary

The headline news attracting attention this week was US and Israel’s attack on Iran and the subsequent “tit for tat” rebuttal. Depending on which news organisation you listen to, the intent of “Operation Epic Fury targeted Iran's leadership (including the assassination of Supreme Leader Ayatollah Ali Khamenei), was to moderate the impact of Iran’s nuclear facilities, missile sites, naval assets, and other military infrastructure. The perception to date is that there will be significant consequences for some Australian agricultural sectors, however the general consensus on the show floors, early in the week was “business as usual” for the trade of wool. Despite the extremely positive result for wool prices this week, we would be naive to think this that this major geopolitical event won’t impact shipping logistics for some or all of Australia’s exported Agricultural product . I feel we should be ready for unintended consequences that may arise from the event. Do not rule out the ability to sell forward some of your next shearing to smooth out any potential bumps.

In summary the direct impact on Australian farm exports (especially meat) is already visible through disrupted shipping and rerouting costs. Indirect impacts like higher fuel costs, higher freight costs, and impact on fertiliser prices could have broader consequences on production costs and competitiveness, even if the conflict is resolved relatively quickly. Whilst wool exports are not totally free of risk, China (our largest export destination) seem to be focussed on the diminishing production in Australia at the moment.